VEXTOR Earnings Report

TRADING REPORT

Period: 14-18 April 2025

Reported on: Saturday, April 18, 2025

By: VEXTORTRADE

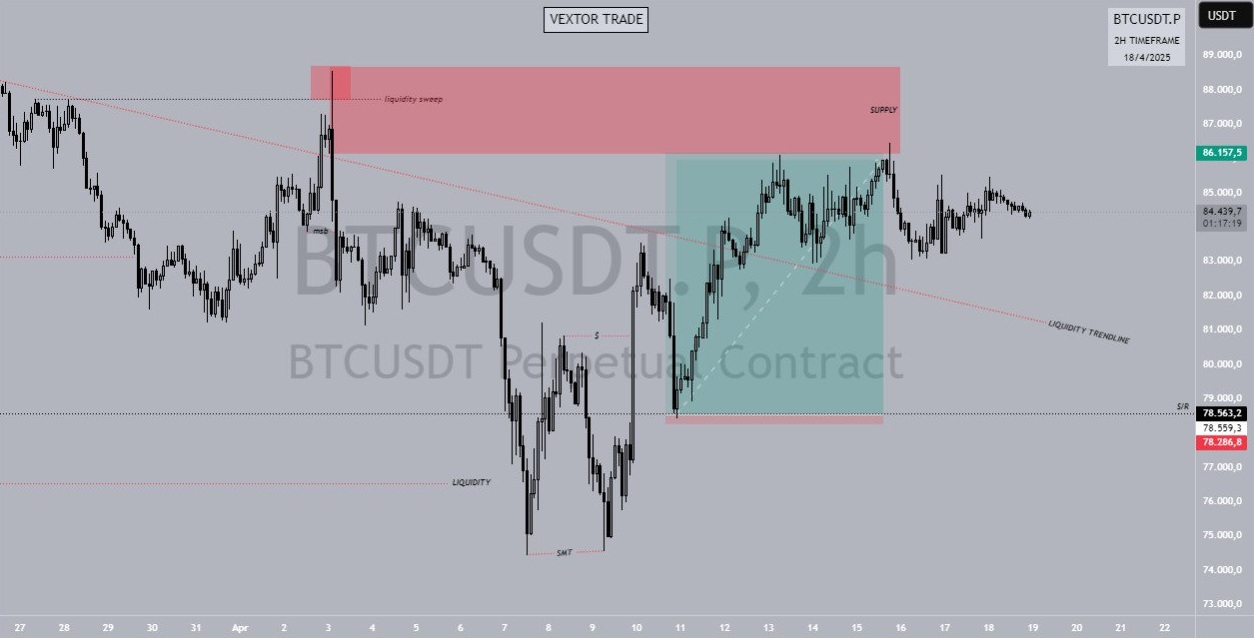

1. Weekly Summary

- Opening Price (April 14): $83,200

- Closing price (April 18): $85,895 (+3.24% weekly)

- Volatility: weekly price range of $80,500 - $86,300 (initial correction followed by bullish rally).

- Total Volume: $280 billion (up 15% vs. the previous week).

2. Daily Analysis (April 14-18, 2025)

14 April 2025

- Price: $83.200 → $81.800 (-1,68%)

- Catalyst: Profit-taking after weekend overbought sentiment.

- Volume: $48 billion (dominant sell-off in the $83,000 zone).

- Key Levels:

- Support: $81,000 (50-day MA retest).

- Resistance: $83,500.

15 April 2025

- Price: $81.800 → $84.100 (+2,81%)

- Catalyst: institutional purchases (US bitcoin ETF inflow of $180 million).

- Volume: $62 billion (dominant buyers below $82,000).

- Breakout: break resistance $83,500 with RSI 58 (neutral-bullish).

16 April 2025

- Price: $84.100 → $85.200 (+1,31%)

- Catalyst: US CPI release (inflation down to 2.8%), prompting speculation *rate cut* Fed.

- Volume: $70 billion (highest this week).

- Technical pattern: Breakout of the *ascending triangle* pattern on the 4-hour TF.

17 April 2025

- Price: $85.200 → $86.300 (+1,29%)

- Catalyst: positive sentiment from Japan's crypto regulation (taxes down).

- Volume: $55 billion (profit-taking in the $86,000 zone).

- Psychological Level: $87,000 resistance test failed (high $86,300).

18 April 2025

- Price: $86.300 → $85.895 (-0,47%)

- Catalyst: a small correction due to the action of *profit-taking* institutions.

- Volume: $45 billion (consolidated above $85,000).

- Indicator: RSI down to 66 (from a peak of 72 on 17 April).

3. Weekly Technical Analysis Patterns & Indicators

- Chart patterns:* Higher Highs & Higher Lows * (uptrend confirmation).

- Moving Average:

- 50-day MA: $83,200 (dynamic support).

- 200-day MA: $78,500 (long-term bullish).

- RSI (7 Days): 66 (neutral-bullish, short-term overbought risk).

- Ichimoku Cloud: the price is above the cloud (bullish signal).

Important Levels

- Main Support:

- $84,000 (liquidity zone of the institution).

- $82,500 (bullish defensive line).

- Resistance:

- $87,000 (breakout target).

- $90,000 (psychological target).

4. Fundamental & Sentiment Factors

1. Bitcoin ETF flow: weekly Inflow of $620 million (largest since Q1 2025).

2. Progressive Regulation:

- US & EU agree on KYC/AML standards for exchanges.

- Japan lowers crypto taxes, encourages retail adoption.

3. Halving 2026: BTC accumulation by miners up 22% (tight supply preparation).

5. Risk Factors

- Macroeconomics: the potential for rising interest rates if US inflation rebounds.

- Geopolitics: Iran-Israel tensions trigger increased volatility of risk assets.

- Technical correction: Profit-taking in the zone of $86,000 - $87,000.

6. Trading Strategies (Next Week: April 21-25, 2025)

- Buy Zone:

- Accumulation at $84,000-$84,500 (stop-loss: $82,400).

- Breakout confirmation above $87,000 (target: $90,000).

- Sell Zone:

- Partial Take-profits at $87,000 and $89,000.

- Beware of bearish signals if $84,000 (risk of Correction to $ 80,000).

- Avoid:

- FOMO in the $86,000 + zone without volume confirmation.

- Short-term Hold if RSI >70.

7. Calendar Of Events (April 21-25, 2025)

- April 22: release of data on US retail sales (influence of risk sentiment).

- April 24: release of US GDP Q1 2025.

- April 25: ECB talks on digital currency policy.

8. Predictions & Recommendations

- Bullish Case:

- Breakout $87,000 → rally to $90,000 - $95,000 (Q2 2025).

- Long-term accumulation in the support zone ($84,000–$82,500).

- Bearish Case:

- If $ 82,500, correction to $ 78,500 (200-day ma).

- Use it as a buying opportunity for the medium term.

9. Weekly Summary

- Main trend: Bitcoin closed the week at +3.24% with bullish sentiment triggered by positive institutional and regulatory inflow.

- Key to success: discipline on support/resistance levels, manage risk with stop-loss, and take advantage of Corrections for accumulation.

- Alert: volatility of macro and geopolitical data.