VEXTOR Earnings Report

TRADING REPORT

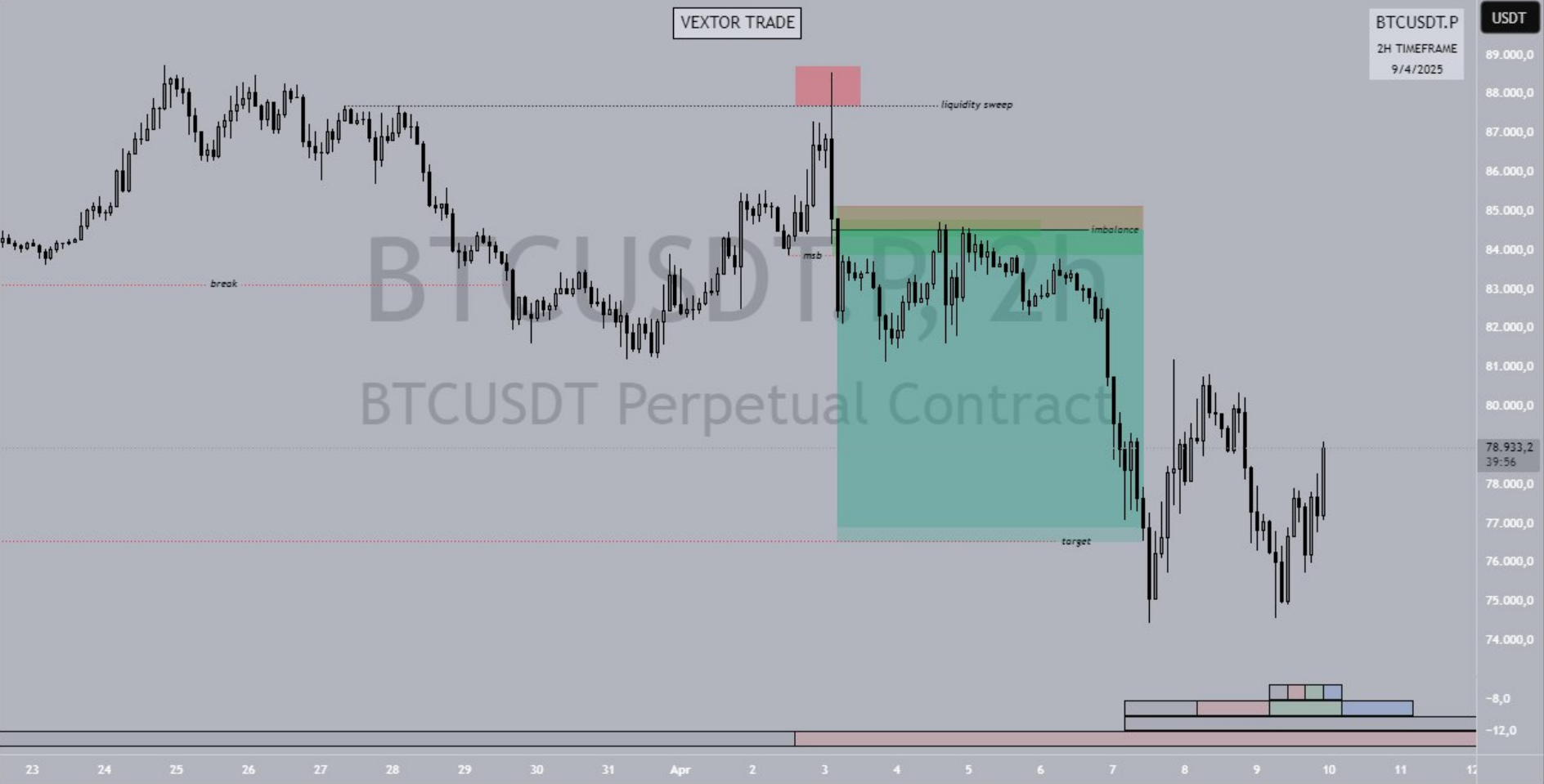

Period: 4-10 April 2025

Reported on: Thursday, April 10, 2025

By: VEXTORTRADE

1. Weekly Summary

- Opening Price (April 4): $82,500

- Closing Price (April 10): $88,200

- Price range: $80,100 (lowest) – $89,750 (highest)

- Weekly Change: +6.9%

- Trading volume (7 days): $240 billion (up 18% from the previous week)

2. Price Movement Analysis Technical

1. Support & Resistance Levels:

- Key Support: $80,100 (retest on April 5).

- Key Resistance: $89,000 (failed to break on April 9).

- Breakout: The Price broke the psychological resistance of $85,000 on April 7.

2. Technical Indicators:

- RSI (14 days): 68 (near overbought, but strong bullish momentum).

- MACD: Bullish crossover since April 6, with the histogram strengthening.

- Volume: 25% volume spike on $85,000 breakout.

#### Fundamental

- Driving Factors:

- Approval of a Bitcoin ETF in Japan (April 8) triggered an outflow of institutional capital.

- Launch of the "Bitcoin Savings" feature by the global fintech platform (April 6).

- The European Central Bank's rate cuts are pushing up risk asset preferences.

- Profit-taking by whale in the $89,000 zone (April 9).

3. Trading Performance

The strategy used

- Swing Trading: Hold long positions since the breakout of $85,000.

- Scalping: take quick profits in the range of $87,000 - $88,500.

Trading Statistics

- Total trades: 22 (16 buy, 6 sell).

- Win Rate: 77% (17 profit, 5 loss).

- Risk / Reward Ratio: 1:3.

- Realized P&L: +12.3% (after fee).

Risk Management

- Average Stop-loss: 2% of entry.

- Diversify with short-term put options at $87,000 as a hedge.

4. Outlook For Next Week (April 11-17, 2025)

Technical Predictions

- Bullish scenario: Break $89,750 → target $92,000 - $95,000.

- Bearish scenario: failure to maintain $85,000 → correction to $82,000 - $80,000.

Anticipated Fundamental factors

- Release of US CPI data (April 13).

- Discussion of the regulation of stablecoins in the European Union (April 15).

- Annual conference of bitcoin miner companies (April 14).

5. Recommendations

1. Buy Zone: accumulation at $85,000 - $86,000 with SL below $83,500.

2. Take Profit:

- TP1: $89,000 (partial profit).

- TP2: $92,000 (if breakout).

3. Avoid: large positions before the US CPI release.

6. Conclusion

Bitcoin closed the week bullish, supported by ETF sentiment and institutional capital flows. However, resistance is strong at $89,000 and correction risks need to watch out for. Focus on breakout confirmation and tight risk management ahead of macro data releases.

Attachments:

- Candlestick chart (1D) with bullish flag pattern (April 4-10).

- Data on the volume and open interest of BTC futures.

Additional Explanation

- Context 2025: higher price assumption driven by institutional adoption and 2024 halving.

- Japanese regulation: the country is becoming a progressive crypto market in Asia.

- US CPI Data: inflation remains a key factor in the movement of risk assets.